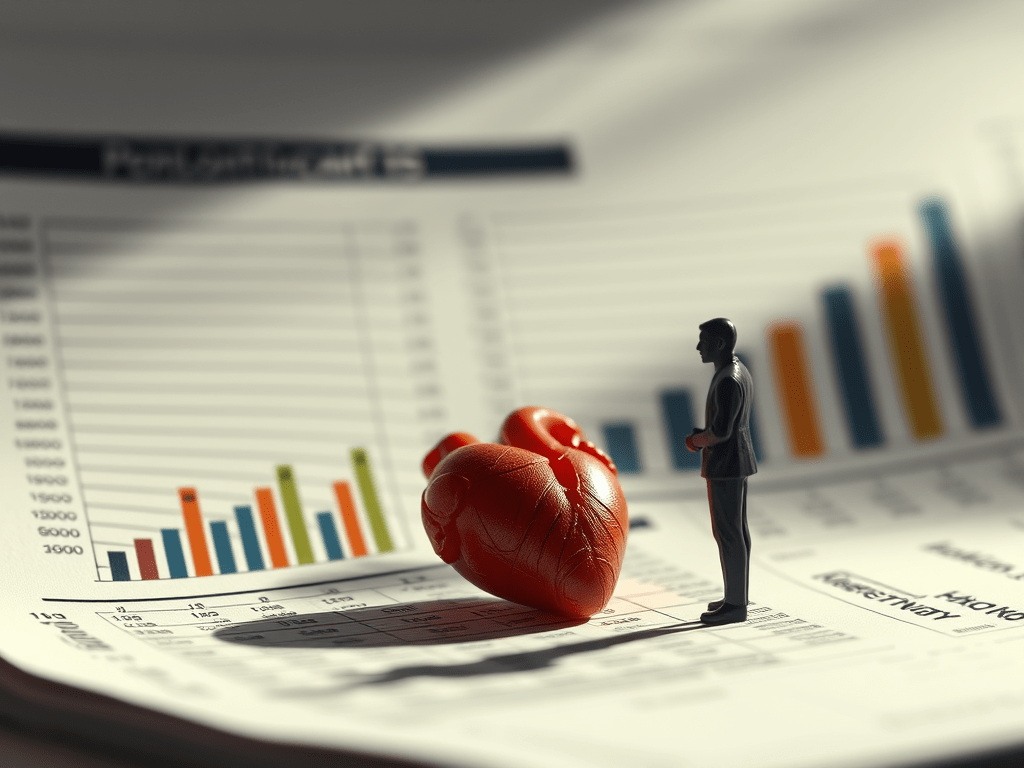

Companies these days try to slip “ESG” and “reputation” into the same sentence—and people nod, pretending they’ve connected the dots. They haven’t. Reputation is all about perception. ESG is hard data and audit trails. Borrowing a line from reality: high ESG scores don’t buy you public love; they buy you investor interest—sometimes.

MSCI’s research shows that companies with stronger ESG profiles tend to enjoy more stable revenues and cash flows, and even pay lower cost of capital—translated: investors pay more for companies that appear resilient. But no one’s buying your sustainability quote deck—they want to know if your product doesn’t suck, and your CEO stays off the front page for scandal. MSCI

Reputation: The Fragile Truth

Reputation lives in perception—what stakeholders believe. It’s built on reliable products, clarity in crises, behavior from leadership, and whether your brand doesn’t embarrass itself on social media. It’s felt, not audited. Run a survey or read the media play—it’s softer, harder to control.

ESG: The Audit Trail, Not the Applause

ESG is about measurable actions: emissions, board diversity, governance structures, and compliance to frameworks like GRI and PRI. These frameworks are legit (and traceable). But they’re not the same thing as a brand’s reputation. One is audit-ready; the other lives in the margin between what people see and what they feel. OECD, MSCI

The Mess When You Mix Them Up

Messing these terms together is not just sloppy—it’s dangerous:

- Greenwashing accusations happen fast. DWS copped a $25M SEC fine after overstating its ESG investment controls. Goldman Sachs got $4M over similar claims. Financial Times, SEC, Crowell & Moring – Home

- You waste credibility. PR teams brag ESG, while the product tanks. That’s the fastest route from praise to finger pointing.

- Compliance becomes theater. ESG metrics become boxes to tick, not signals of real change.

Strategy, Not Spin

Here’s how to do it right:

- Split the work. ESG stays with sustainability/compliance teams. Reputation stays with comms/marketing. They talk—but don’t merge.

- Use different KPIs. ESG: carbon intensity, DEI ratios, audit compliance. Reputation: sentiment surveys, brand trust scores, media tone.

- Tell separate stories. “Here’s what we did” (ESG). “Here’s why it matters to you” (Reputation).

Reputation vs ESG

| Dimension | Reputation | ESG |

|---|---|---|

| Nature | Perception-based, shaped by trust and experience | Performance-based, grounded in measurable data |

| Core Drivers | Product quality, leadership, crisis response | Emissions, DEI ratios, governance structures |

| Measurement | Surveys, media sentiment, brand trust indices | GRI/PRI reporting, ESG audits, regulatory screens |

| Stakeholders | Customers, employees, media, communities | Investors, regulators, rating agencies |

| Risks of Conflation | Hyped ESG with poor product erodes trust quickly | Real ESG claims get ignored if not tied to reputation |

| Intersection | Reputable ESG fuels trust, but trust needs substance | ESG supports reputation only if communicated honestly |

Sources

- MSCI (2021). Insights on MSCI ESG Ratings and Business Performance

- OECD (2020). ESG Investing: Practices, Progress and Challenges.

- United Nations Principles for Responsible Investment (PRI).

- Global Reporting Initiative (GRI) Standards.

- Eccles, Robert G. & Klimenko, Svetlana (2019). The Investor Revolution. Harvard Business Review.

- U.S. Securities and Exchange Commission (2023). SEC Charges Investment Adviser with Misleading ESG Claims.

- Financial Times (2023). SEC fines Goldman Sachs for “greenwashing” ESG funds.

- Crowell & Moring LLP (2023). The Ups and Downs of the SEC’s Now-Dissolved ESG Task Force.

Leave a comment