Governance used to mean something. Gravitas. Duty. A few solemn people pretending to act in the company’s best interest while quietly plotting their next directorship. Now? It’s part high school cafeteria, part political theatre. The boardroom isn’t where governance happens—it’s where reputations are traded, gossip doubles as strategy, and survival depends on who controls the narrative.

Power still moves quietly, but no longer discreetly. Slack channels, side texts, and leaks blur the line between deliberation and performance. Truth exists only long enough to be spun into perception. The modern boardroom is no longer a seat of governance—it’s a stage lit by shareholder scrutiny and social media glare, where every move is broadcast, analyzed, and misinterpreted in real time.

The Whisper Network and the Scorecard of Survival

Behind the sleek agendas and corporate courtesy lies a shadow economy of whispers. Information doesn’t flow; it circulates, distorted at every stop. A casual remark becomes consensus, consensus becomes doctrine, and before long, a company’s direction shifts because someone wanted to sound well-informed at dinner.

These whispers feed an invisible scoring system. Every executive is quietly ranked by reputation—who listens to them, who avoids them, whose confidence they can still fake. It’s not written down anywhere, but it decides everything. Lose credibility, and you don’t get fired—you just stop being consulted. The meeting goes on without you.

The real game of governance isn’t about oversight or fiduciary prudence. It’s about controlling the room before the room controls you. A single slip—a tone-deaf remark, a rumor taken as fact—and the unwritten scorecard updates instantly. Your value, measurable in gossip velocity, declines overnight.

When Governance Goes Viral

Once upon a time, scandal had a cooling period. Now, a single screenshot can melt a reputation before the next board packet lands. Internal politics spill into public feeds, reshaping corporate identity in hours. The idea of a “closed-door” meeting is a historical artifact; the audience is always watching, sometimes recording.

Leadership has turned performative by necessity. Every message must please investors, employees, regulators, and the internet’s collective sense of morality—all at once. The choreography of sincerity is exhausting. Governance becomes theater, and the executives are actors pretending to improvise.

The irony? The more transparent companies try to appear, the more staged they look. Authenticity has become another KPI—measured in likes, retweets, and whether your apology video sounds rehearsed.

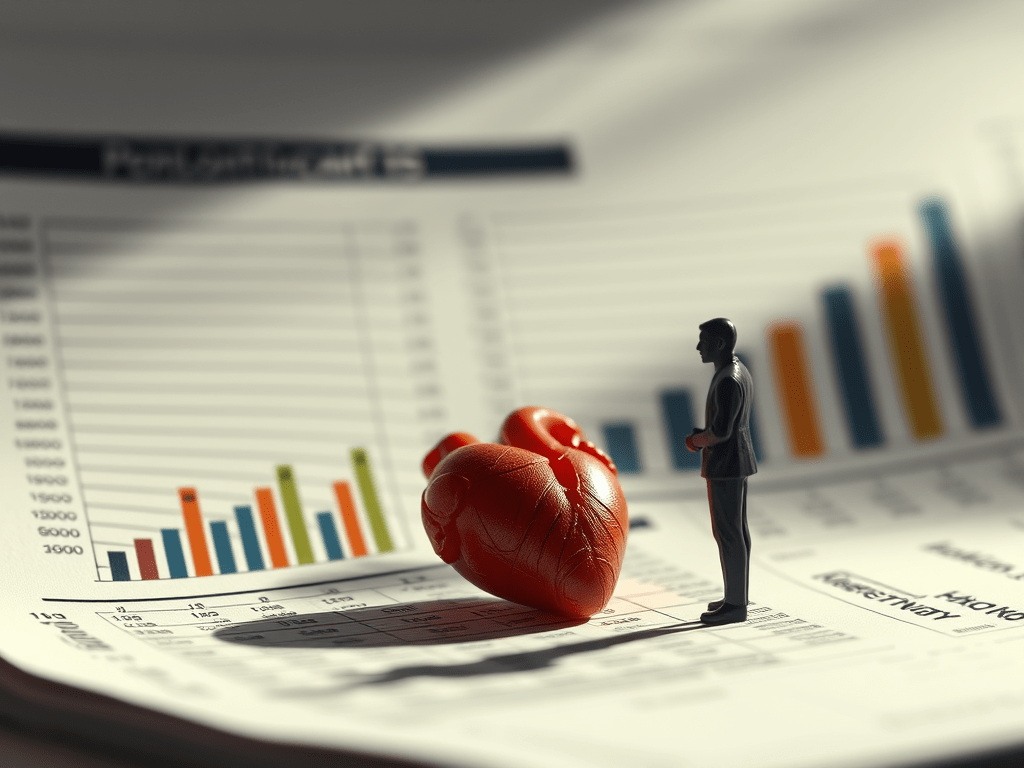

The ESG Warfront

ESG was meant to fuse values with strategy. Instead, it’s become a battleground where virtue is monetized and activism is corporate warfare. Boardrooms now fight over who gets to define “responsibility.” The debates aren’t about carbon targets or labor standards—they’re about optics.

The Exxon vs. Engine No. 1 fight made it obvious: even titans can lose ground to moral insurgents with good branding. Activists wield ESG language like a scalpel—cutting into governance under the guise of reform. Some companies adapt; others double down on platitudes and hope investors mistake PR for progress.

In this war, values aren’t guiding principles—they’re tactical assets. Governance isn’t about doing the right thing; it’s about proving you did something that looks right.

Beyond the Battlefield

If governance wants redemption, it must abandon performance and return to principle. Substance over show. Accountability over choreography. ESG should be a system of integrity, not an influencer campaign.

Reputation can no longer be managed like an ad buy—it must be earned through behavior that holds up when no one’s watching. Until then, the boardroom remains what it’s become: a rumor mill with a catering budget, where the most dangerous weapon isn’t malice—it’s the microphone left on after the meeting ends.

Sources & Further Reading

- Fombrun, C. J. & van Riel, C. B. M. (1997). The Reputational Landscape. Corporate Reputation Review, Erasmus University Repository.

- Larcker, D. F. & Tayan, B. (2023). Seven Gaping Holes in Our Knowledge of Corporate Governance. Hoover Institution Working Paper.

Alternate sources: SSRN Abstract Page | ECGI Working Paper Record - Pargendler, M. (2014). The Corporate Governance Obsession. Stanford Law School.

- Ravasi, D., Rindova, V. P., Etter, M., & Cornelissen, J. P. (2018). The Formation of Organizational Reputation. Academy of Management Annals, Open Access version.

- Edelman (2024). 2024 Edelman Trust Barometer: Global Report. Edelman.com.

- Bebchuk, L. (2009). What Matters in Corporate Governance?. Harvard Law School, John M. Olin Center Discussion Paper.

- Harvard Law School Forum on Corporate Governance (2021). Was the Exxon Fight a Bellwether?.

- Harvard Law School Forum on Corporate Governance (2021). Why ExxonMobil’s Proxy Contest Loss Is a Wake-Up Call for All Boards.

- University of Chicago Business Law Review (2022). The Hedge Fund Activism of Engine No. 1.

Leave a comment