Capitalism is the original KPI addict. Every quarter, it grades itself on profit margins, GDP growth, and shareholder value—metrics that measure motion, not meaning. This is KPI Voodoo: the illusion of precision in a system that mistakes numbers for truth.

The Annual Review: Capitalism’s Self-Evaluation Problem

Each year, the global economy performs its ritual checkup, pretending that a spreadsheet can diagnose a soul. Churchill once called capitalism “the unequal sharing of blessings.” Schumpeter called it “a machine for change.” Both were right. The system innovates brilliantly and distributes miserably.

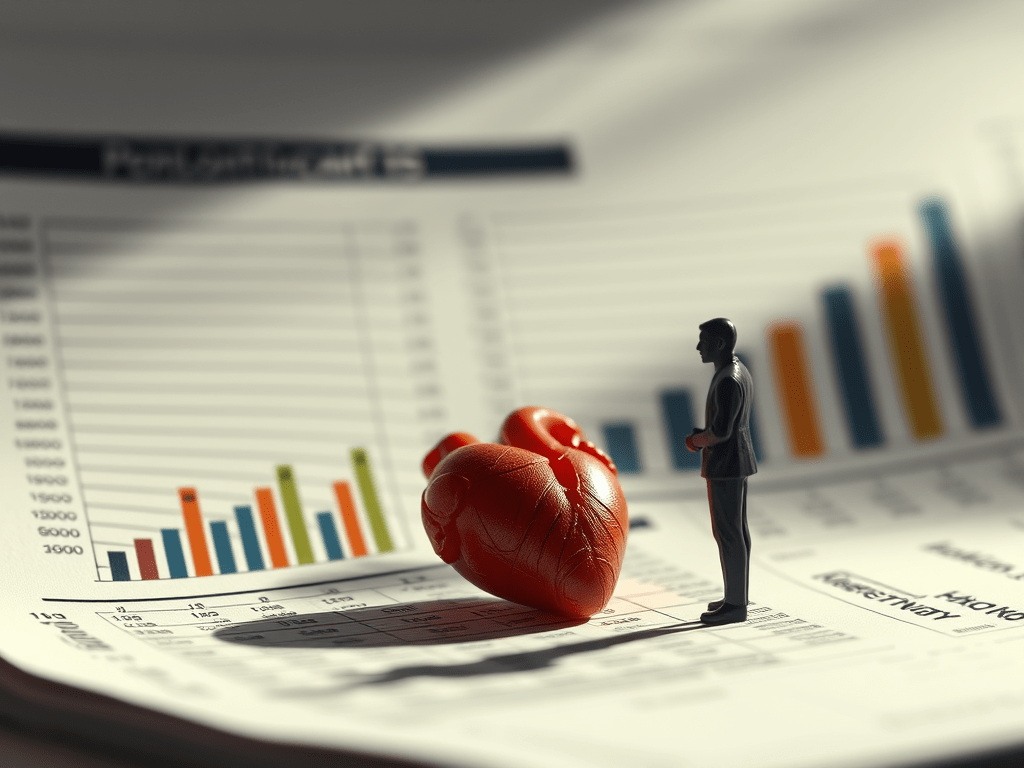

GDP remains capitalism’s vanity mirror—polished, shallow, and self-flattering. Simon Kuznets, who helped invent it, warned that GDP was never meant to measure welfare. We ignored him. GDP counts oil spills and medical bills as “growth,” as long as someone paid for them. It’s capitalism’s favorite illusion: that more is automatically better.

What We Measure—and What We Miss

Capitalism loves its glossy KPIs—growth, output, efficiency—but the real indicators of health are buried in the fine print:

- Social Mobility: Can people actually move up?

- Sustainability: Can the planet survive our balance sheets?

- Equity: Who benefits, and who’s left holding the invoice?

Profit remains the system’s heartbeat—and its arrhythmia. The same motive that fuels innovation fuels exploitation. For every new technology, there’s a new extraction: of labor, land, or attention. Regulation isn’t an enemy of capitalism; it’s its survival instinct. Without it, the market becomes a casino where only the house wins.

Off-Balance Sheets and Closed Markets

Capitalism’s accounting is creative, to put it mildly. Environmental damage, social collapse, cultural erosion—they’re all filed under “externalities,” meaning “not our problem.” But these costs don’t vanish; they metastasize. Kate Raworth calls for a doughnut model—growth that fits inside planetary limits. Capitalism still wants the sprinkles.

Meanwhile, the system that worships “competition” has quietly consolidated into cartels of convenience. Fewer companies, more control. Efficiency becomes monopoly; innovation, acquisition. The invisible hand? More like an inside job.

Reimagining the Incentive Engine

Capitalism doesn’t need to be burned down; it needs to be rewired. Incentives should reward long-term value, not quarterly vanity. Data should serve insight instead of illusion. As Thomas Davenport argued, advantage comes from organizations that collect, analyze, and act on data with discipline. A new scorecard that prices impact alongside income is capitalism’s only shot at relevance.

If the future is to be invented, as Alan Kay put it, then the blueprint must include impact—not just income. A system that values sustainability, well-being, and equity isn’t utopian—it’s overdue.

The Next Performance Cycle

The review is coming due. Capitalism can either evolve or collapse under its contradictions. Growth without restraint is decay; innovation without empathy is extraction. The next performance cycle isn’t about quarterly returns—it’s about survival. The question isn’t whether capitalism performs, but whether it still deserves the job.

Sources

- OECD: Society at a Glance 2024 – Indicators of Social Well-Being (PDF)

- UNEP: Emissions Gap Report 2024

- Joseph Schumpeter, “Creative Destruction” (Econlib overview)

- Simon Kuznets, National Income, 1929–1932 (NBER PDF)

- Kate Raworth: Doughnut Economics

- Thomas Davenport, “Competing on Analytics” (HBR)

- Alan Kay quote, BrainyQuote

Leave a comment